Tackling Elder Financial Abuse: A UK Perspective

The Hidden Impact of Fraud

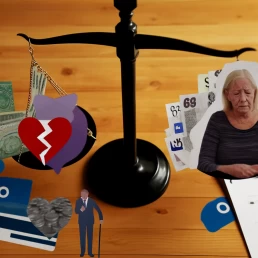

Elder financial abuse remains a critical issue in the UK, with many cases going un investigated. A recent experience highlighted the plight of a client affected by identity fraud, where a former partner misused her identity to accrue significant debt. This case underscores the extensive impact of fraud, affecting not only financial institutions but individuals’ lives and mental health.

Challenges in Fraud Investigation

Law enforcement’s initial stance was to view financial institutions as the primary victims, overlooking the significant emotional and financial toll on individuals like my client. Despite clear evidence of fraud, systemic hurdles and a lack of proactive measures from both police and banks made resolving the case exceedingly difficult.

Institutional Apathy and Systemic Barriers

This case encountered considerable institutional apathy, with neither the police nor the banks willing to take decisive action. This professional indifference, combined with procedural barriers, emphasizes the need for a more effective system to combat and prosecute fraud.

Seeking Accountability

The reluctance to address these fraud cases can be attributed to systemic issues and limited resources within the police service. The real accountability lies with senior decision-makers and, ultimately, the government, which has yet to fully address the escalating issue of financial crimes.

The Rising Cost of Fraud in the UK

Recent research has illuminated the substantial annual cost of fraud in the UK, particularly in the financial sector. This trend not only emboldens fraudsters but also signifies the urgent need for a more robust response to financial crimes.

Ethics, Public Interest, and Policing Priorities

The UK’s police service, bound by a Code of Ethics, often prioritizes violent crimes over fraud due to the perceived lower immediate threat. This approach neglects the significant, often hidden, harm caused by financial crimes and the importance of investigating them in the public interest.

Advocating for Systemic Change

The case exemplifies the critical need for a shift in perspective regarding fraud within law enforcement and governmental policy. Recognizing the broader impact of financial crimes is essential for providing justice and support to victims.

A Call to Action: Addressing the Societal Impact of Fraud

Addressing the challenge of financial crimes requires a collective effort from the government, law enforcement, and society. Recognizing fraud as a significant societal issue is crucial for implementing effective preventative and prosecutorial measures.

Conclusion: Recognizing the Broader Implications of Fraud

Fraud extends beyond financial losses, affecting individuals and society’s fabric. Advocating for a more empathetic and proactive approach to fraud prevention and prosecution is imperative for protecting the most vulnerable and ensuring justice for all affected.